Divest from Genocide: Break Up With Your Bank!

We’re calling on Canadians to sign the pledge to remove their money from banks funding genocide and to reinvest it in more ethical alternatives, such as local credit unions.

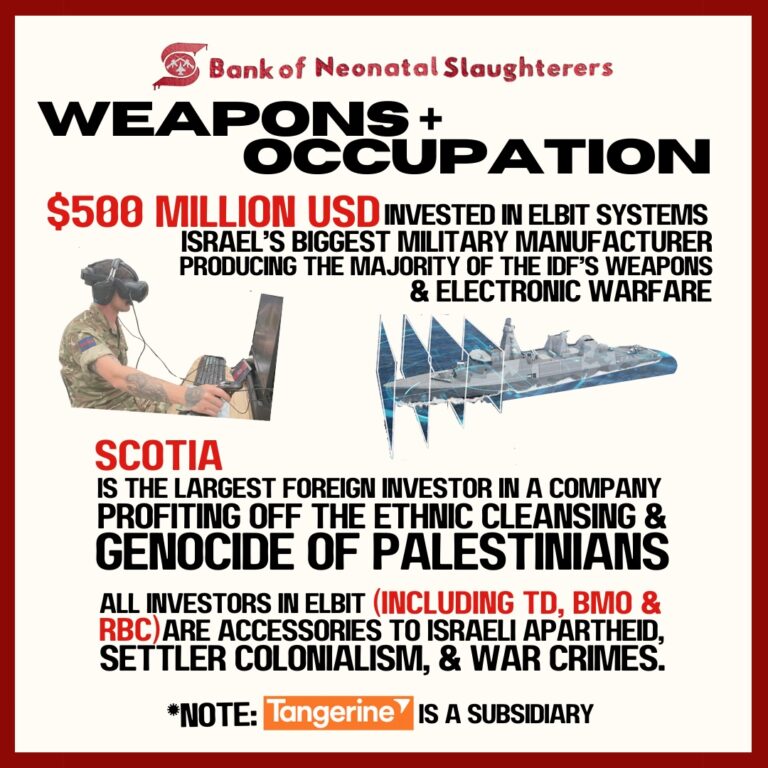

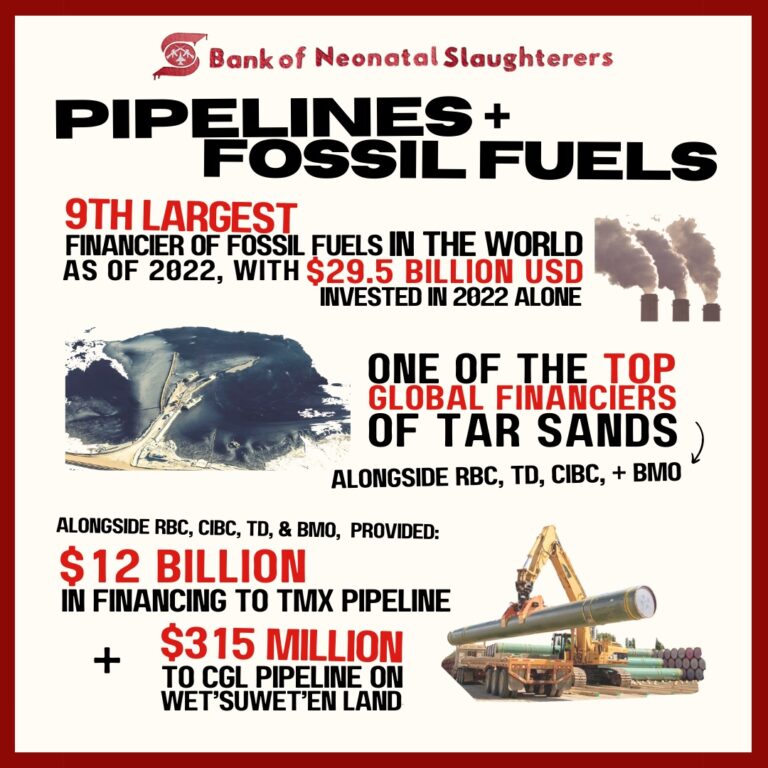

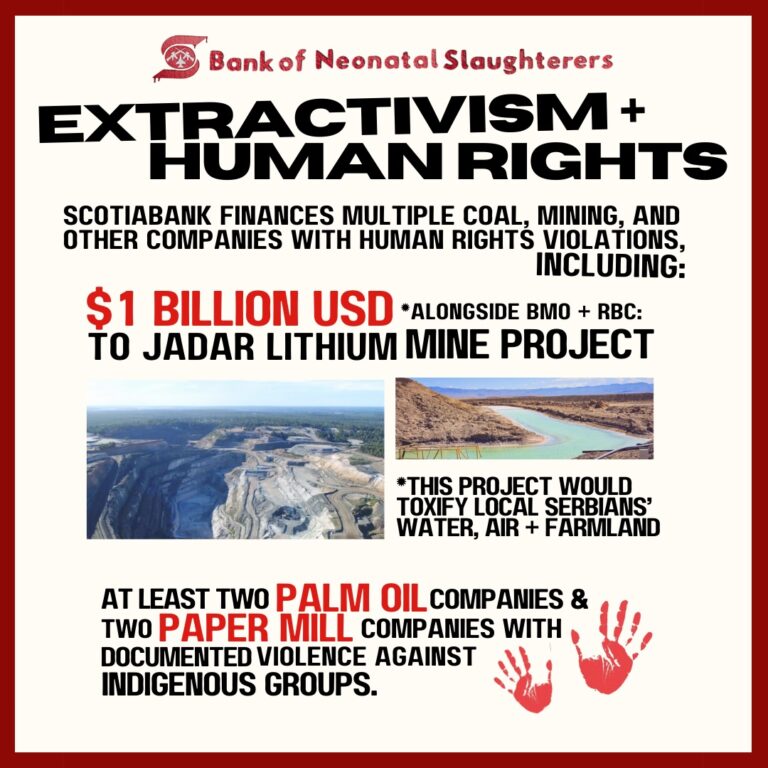

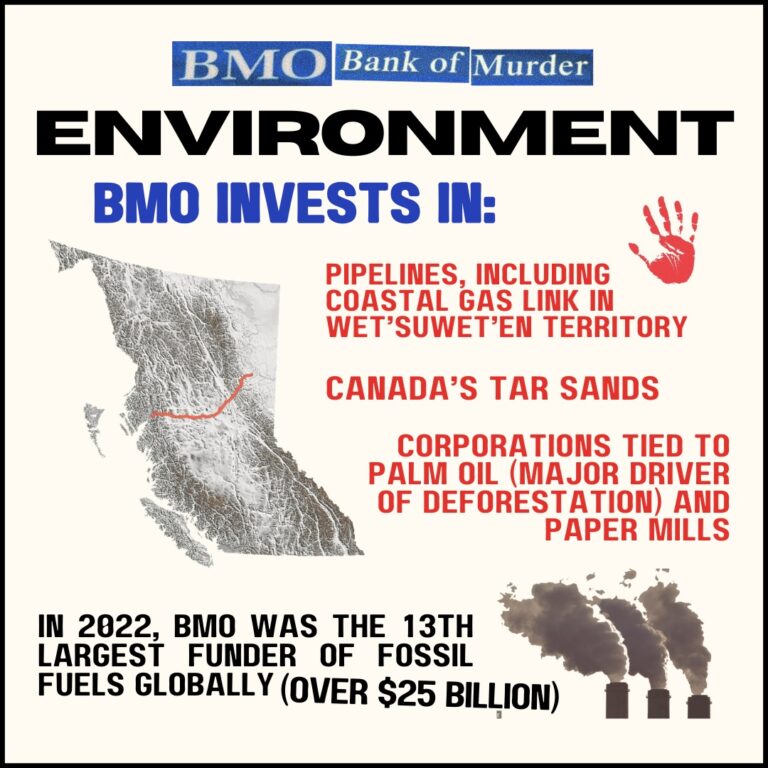

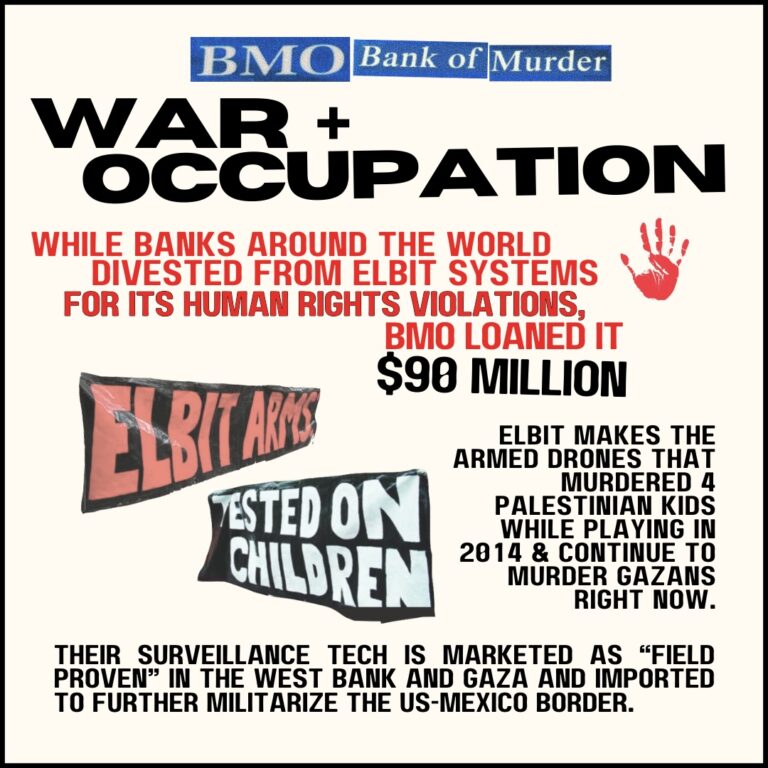

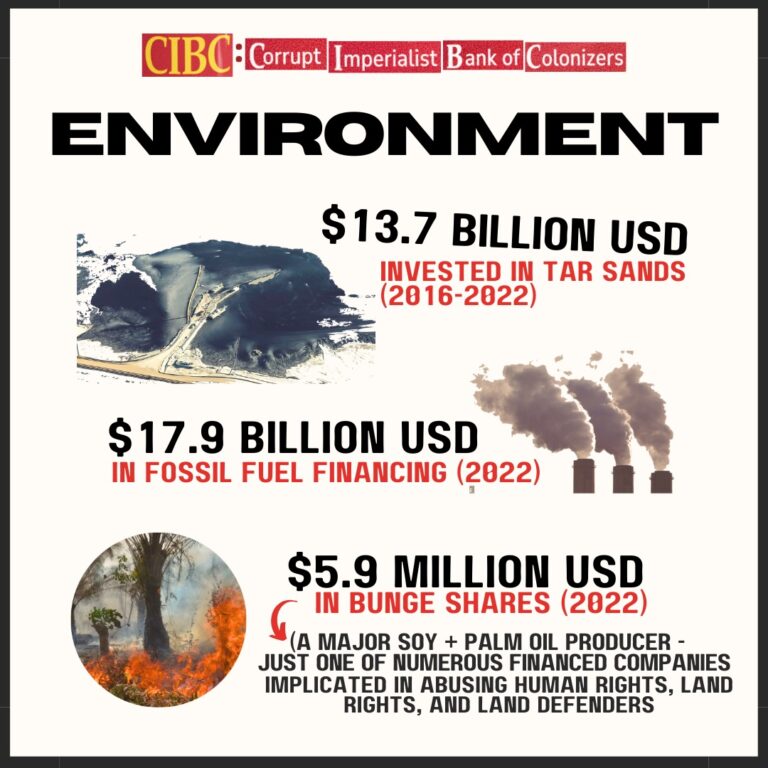

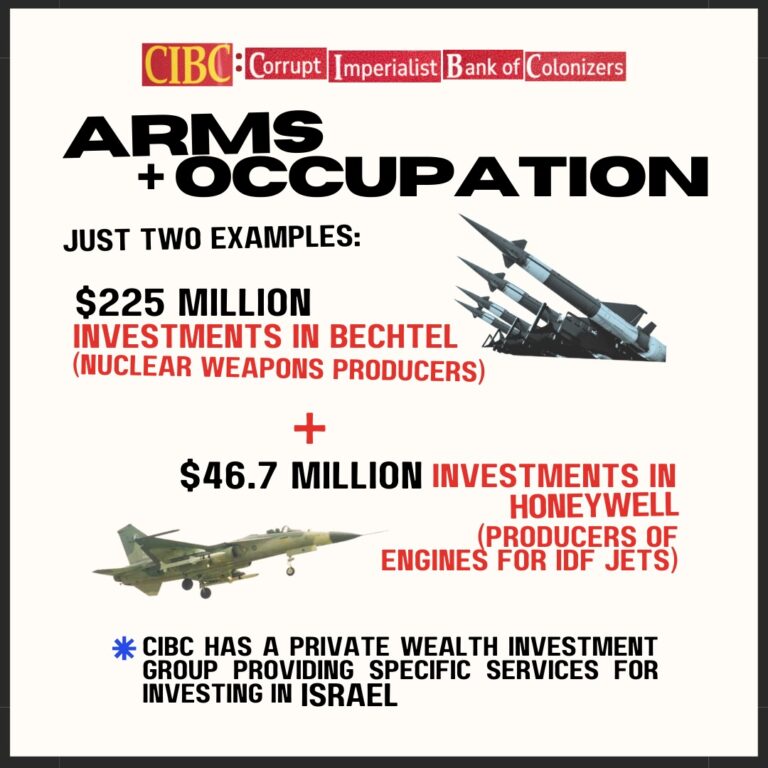

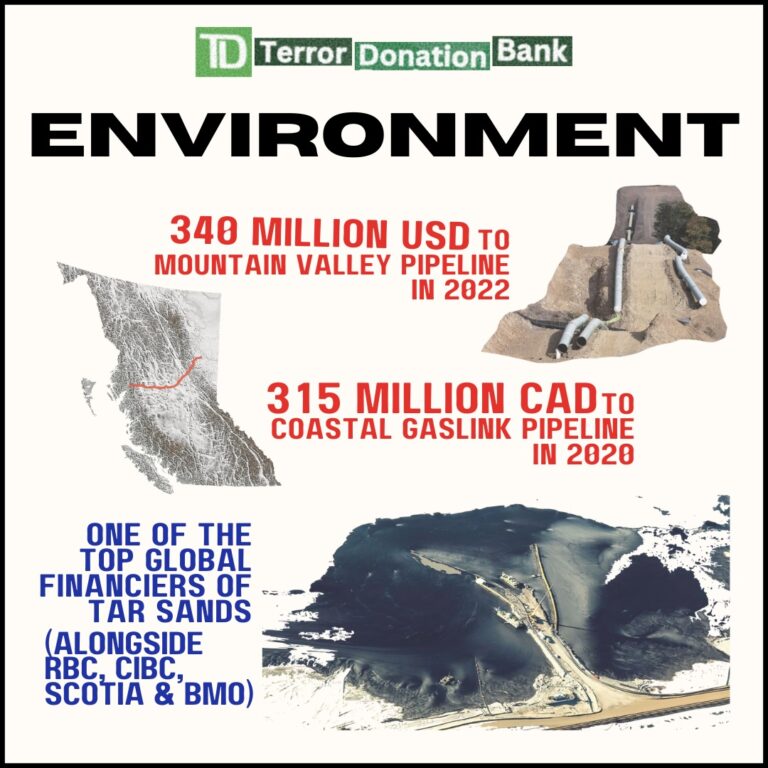

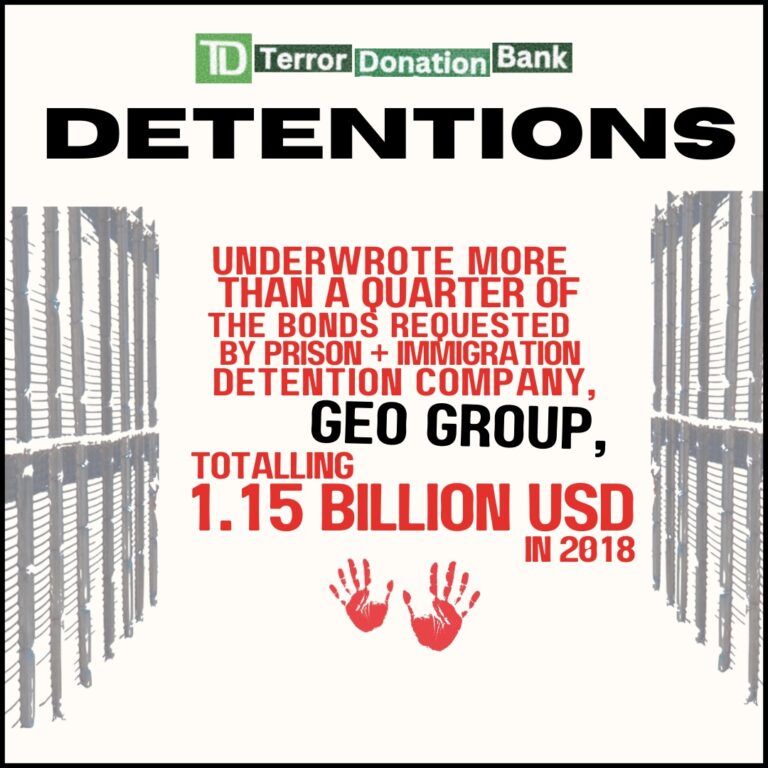

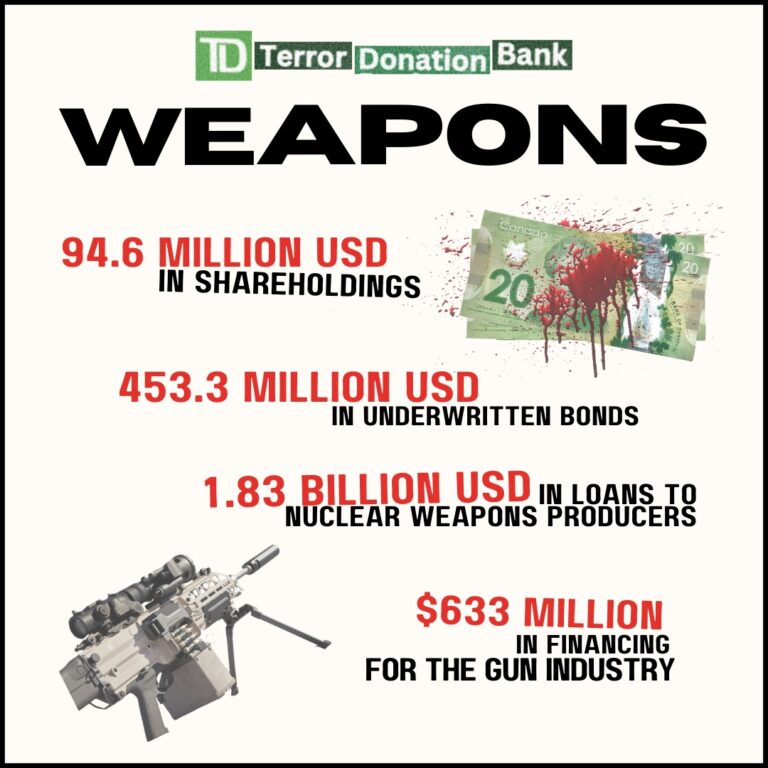

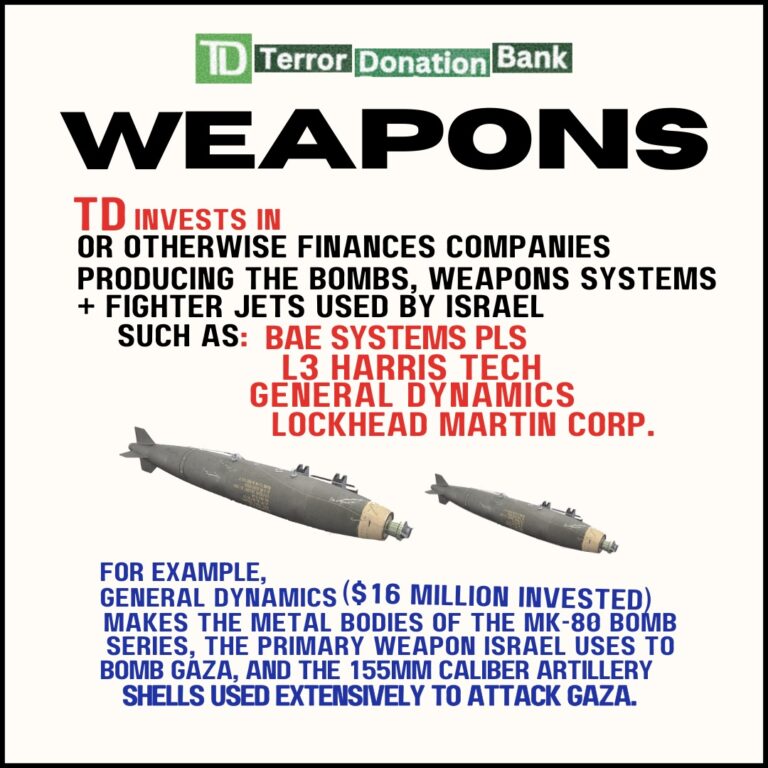

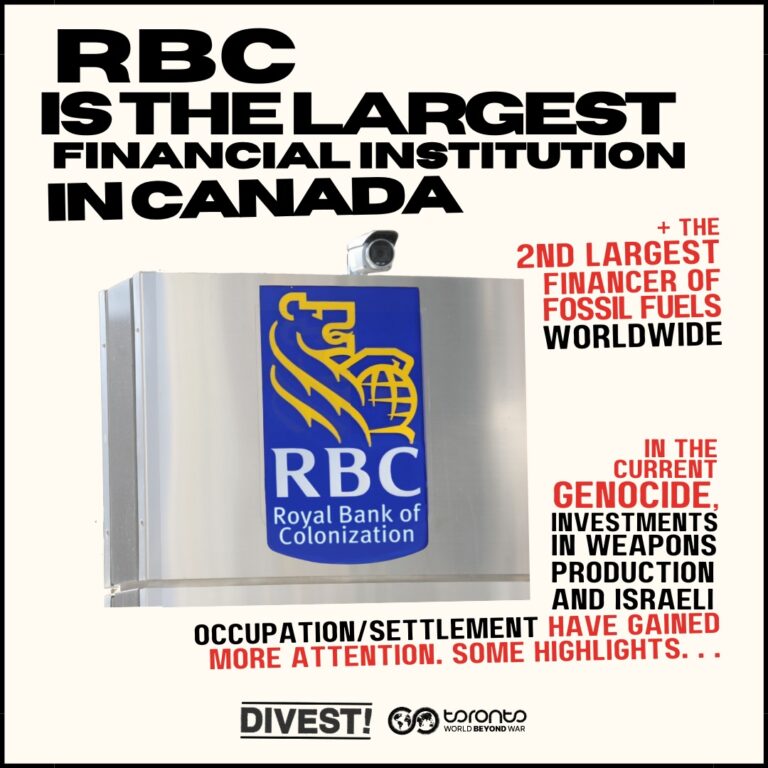

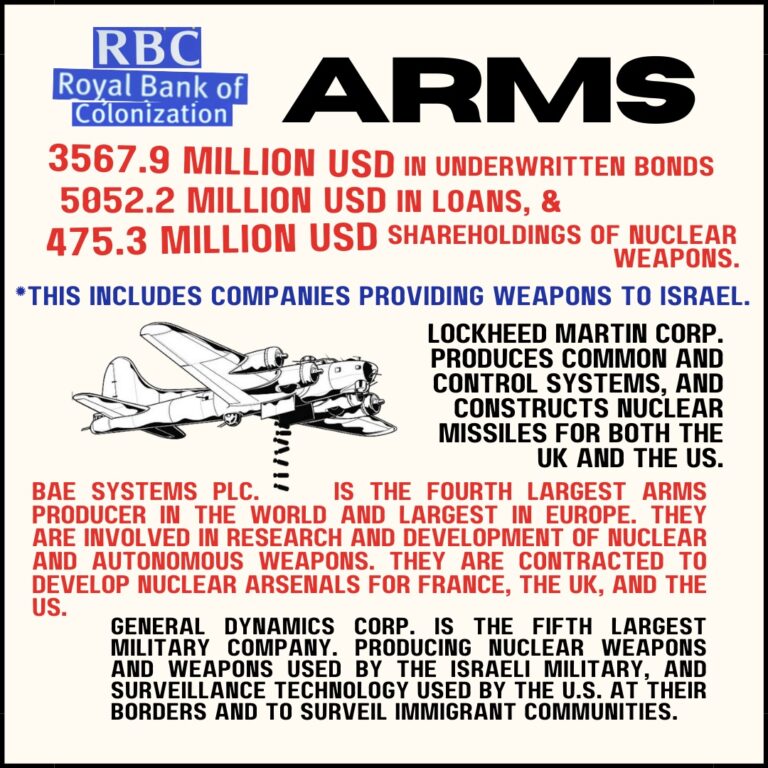

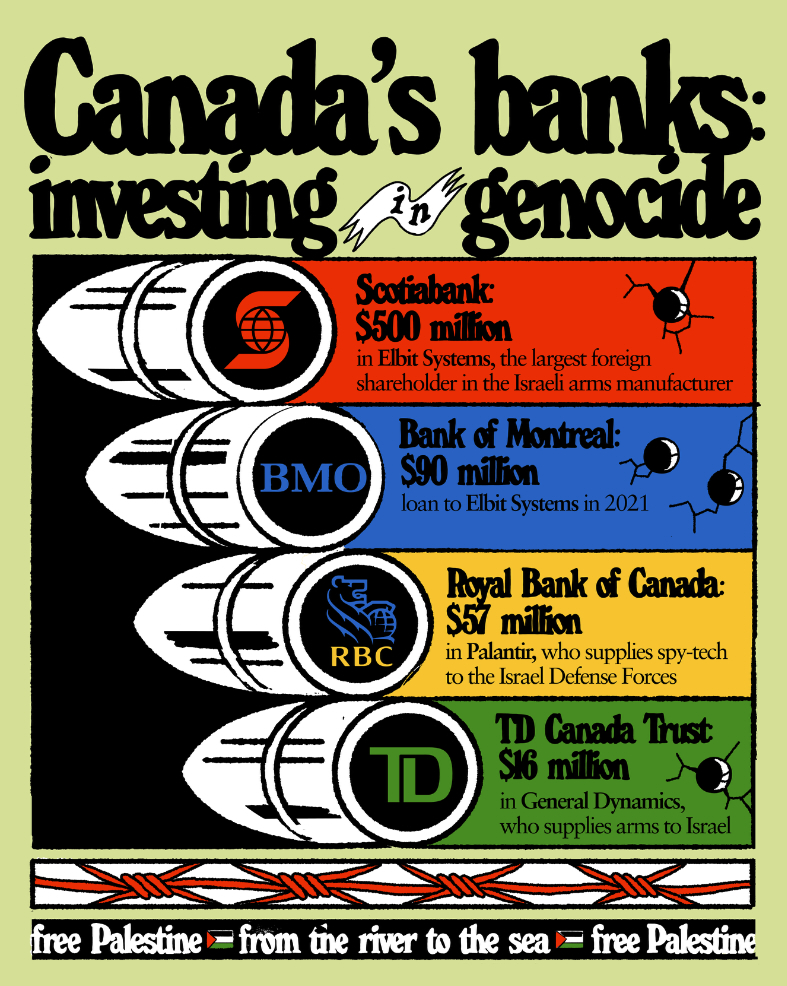

Why pledge? To start, Scotiabank, CIBC, Bank of Montreal, RBC and TD invest heavily in arms manufacturing companies that directly supply weapons the IDF is using in the brutal genocide of Palestinians. They’re major financers of climate disaster, occupation, and war around the globe.

Read more below…

Opt in to our emails in the form above to receive resources, events, and other opportunities to connect with a community of people committed to divesting from banks and finding more ethical alternatives.

Canadian Banks are Funding the Companies Arming the Israeli Military

The graphic below shows only a few of Canadian banks’ investments in the weapons manufacturing currently arming Israel. All big banks invest heavily in weapons, military surveillance, and fossil fuel industries, fueling war, occupation, and climate disaster around the world.

For example, the Campaign to Abolish Nuclear Weapons reports that Canada is “the fifth highest investing country [in nuclear weapons producing companies] with a total of $26,383,000,000 USD in investments…Shockingly, that is almost 1 million dollars PER Canadian!” The Big Banks (and Desjardins) are among the highest investors in that figure.

According to Bank Track, Scotiabank (subsidiary includes Tangerine), BMO, Manulife, and RBC all financially support the illegal Israeli settlements in Occupied Palestinian Territory via shares in Israeli banks. Furthermore, Canadian banks have failed to divest from the 112 companies listed in the UN database of companies complicit in illegal Israeli settlements on Occupied Palestine.

What Is My Bank's Role?

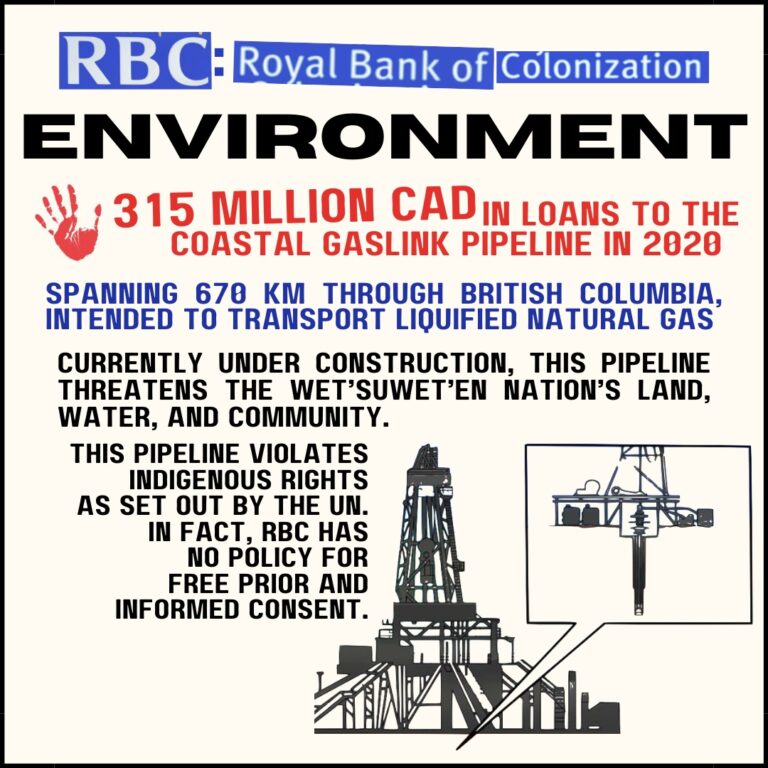

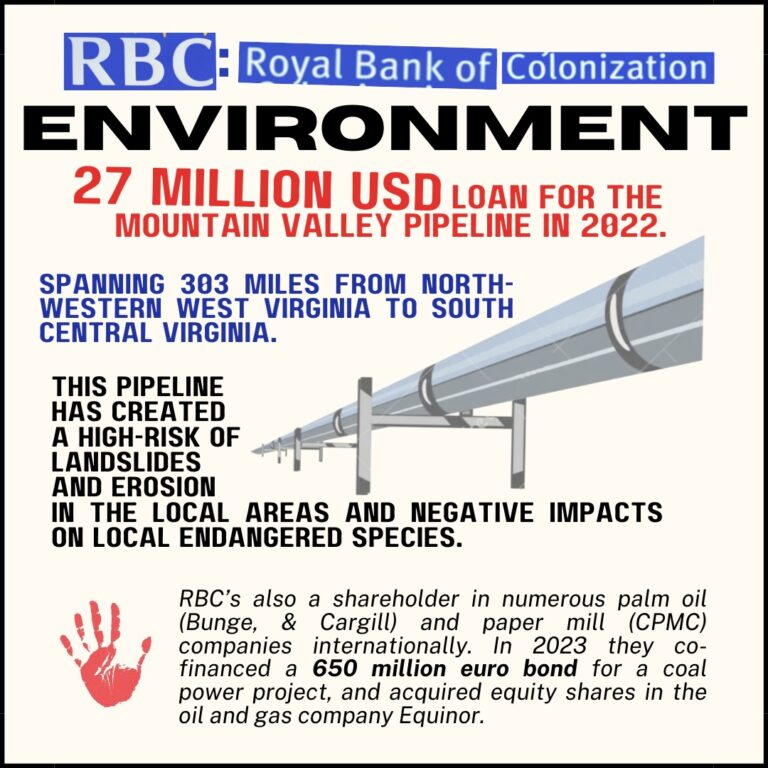

Climate Disaster and Violations of Indigenous Rights

Banks and investment firms often try to manipulate us with performative, superficial, or outright duplicitous initiatives claiming to protect the climate (greenwashing), work with Indigenous communities (redwashing), or make a social impact (impact washing). But as Matt Price, executive director of Investors for Paris Compliance, recently stated: “At best, sustainable finance as currently practiced by Canada’s big banks is a $2 trillion placebo. At worst, it is greenwashing of carbon-intensive businesses, misleading investors and the public.”

Since Canadian banks signed the Paris climate agreement in 2016, they’ve become 5 of the 6 largest global financiers of tar sands — this amounts to over $700 billion in investments. RBC alone is the largest financier of fossil fuels worldwide.

The Yellowhead Institute has noted the Big Five Canadian banks’ lack of meaningful implementation of Free, Prior and Informed Consent (a right of Indigenous communities outlined in UNDRIP). The found rampant “redwashing” in which banks hide beyond “self-serving certification processes and vague Corporate Social Responsibility (CSR) principles” while continuing to fund projects violating Indigenous peoples’ rights at places like Standing Rock, Wet’suwet’en Yintah, and along the Transmountain Expansion.

Convinced it’s time to move on?

Divesting is a powerful way to let banks know that we do not consent to our money being used to fund genocide, human rights violations, colonization, and climate destruction. Collectively, we’re increasing pressure on Canadian banks to divest, while re-investing our money in a better world — a world beyond war.

Why Are Credit Unions a Better Alternative to Banks?

Credit unions and caisse populaires (Quebec) are member-owned, cooperative financial institutions. This means they’re owned and controlled by the people who use them, offering pathways for accountability unavailable at banks. Some credit unions return profits to members as dividends, reduced fees, higher savings rates, or lower loan rates. Profits are also frequently donated or invested into local community initiatives.

At credit unions, you’re a member/shareholder, not just a customer. This means you get a say in how the institution is run, including an equal vote (regardless of your account or investment sizes) to elect the volunteer-run board of directors. This democratic process and the explicit community focus of credit unions generally make them a more ethical alternative, while offering many of the same products and services (personal and business) as big banks! Your money is protected and government-insured, just like at a bank.

Use this interactive map to find a credit union near you! https://ccua.com/about-credit-unions/find-a-credit-union/

Use this detailed guide from our friends at Change Course and For Our Future on how to move your money from a bank and choose the credit union that’s best for you. They’ve also put together some profiles of credit unions’ policies on fossil fuels.

Bank Green’s searchable database gives you a report on banks and major credit unions’ environmental impact.

Credit unions/caisse populaires aren’t immune to unethical investments or practices like greenwashing, redwashing and impact washing. As one example, Desjardins is heavily invested in Jacobs Engineering, which supports nuclear weapons modernization. While that’s seriously disappointing, don’t be discouraged! As members we have more power and pathways to hold our credit unions to account. Ask if they have or will commit to excluding investments in:

- fossil fuels and mining

- weapons, prisons, and policing

- companies listed in the UN database of companies complicit in illegal Israeli settlements on Occupied Palestine

- companies listed by the BDS Coalition

- companies violating Indigenous rights, outlined in UNDRIP

By becoming a member at a credit union/caisse populaires, you not only divest away from banks who will always put profits over people, you also become one more advocate for community-focused financial institutions. Once you make the switch, fill out our quick, anonymous survey to tell us about it! This helps us track the collective impact.

Does making a total switch right now seem overwhelming? That’s okay!

First, sign the pledge to commit to moving your money as soon as you’re able.

You can start by moving a portion of your savings out of your bank and into a local credit union. Moving a lump sum of savings will hit your bank where they can feel it. Let your bank know why you’re moving on! We’ve drafted a breakup note to help you.

Switching over savings and checking accounts to a credit union/caisse populaire is pretty simple, but the funds and stocks you’re personally invested in through any financial institution could be problematic. Here’s some ways to explore…

Know What You’re Invested In

Do you have an updated list of your current stock holdings and/or funds you’re invested in? You can ask your financial advisor for this if you have one. For funds administered by an institution (e.g. a group RRSP through an employer), this may be readily available online or you can request it from the institution.

Next, check out those companies! Many tools are available to check if funds or companies are invested in weapons, nuclear, mass incarceration, occupations, border & surveillance, or fossil fuels:

Not Happy With Those Investments? Divest!

You might choose different options depending on your situation and the investment. If you’re individually invested in an unethical fund or company, that’s an easier fix because you have control! Talk to your financial advisor about hard exclusions (e.g. “I do not want to invest in any companies involved in the weapons, prison, fossil fuel or mining industries, and I want to exclude the 112 companies listed in the UN Database as complicit with Israeli war crimes”).

Consider that ‘responsible investing’ options may include investments in governments, ‘green’ companies, and banks supporting war, occupation, surveillance, etc. You’re allowed to ask about and exclude anything—it’s your money!

If your institution is offering the problematic funds, pressure it to divest from particular funds and offer ethical funds, or ask the fund manager to remove problematic companies from funds (if there’s just a few). This is a powerful move — see if you can work with others to make these institutional calls! Push for institutions and fund managers to create clear and specific policies for what they exclude and include in investments. Check out https://worldbeyondwar.org/divest/ for toolkits and examples of successful divest campaigns targeting institutions, cities, and schools!

Is your pension plan invested in war crimes? For most Canadians, it absolutely is. Check out our divest campaigns targeting the Canadian Pension Plan and the Ontario Teacher’s Pension Plan.

Invest in Something You Can Feel Good About!

Your choices to invest are equally powerful as your choices to divest! If you have individual control over your investments, some of the tools/databases listed above can help you find investments you can feel good about (e.g. https://fossilfreefunds.org/).

Consider a community impact investing strategy that infuses capital into local projects with social and/or environmental benefits. It prioritizes the agency and self-determination of communities often excluded from conventional investments.

Tell your financial advisor what you’d like to invest in and what options they have. You might want to look for a financial advisor who specializes in Socially Responsible Investing. Don’t be afraid to ask questions, be specific, and be insistent—this is your money, not theirs!

What About My Mortgage?

We can’t tell you what’s best to do regarding mortgages or other loans through banks. The timing and consideration of this will be case-by-case. But it’s definitely worth looking into—divesting your mortgage is an especially powerful move! Your new lender, such as a credit union, might even help cover the costs associated with the switch. Talk to credit unions about your interest in moving your mortgage over and see what they can offer.

Break Up With Your Bank Webinar

On March 20, 2024 Toronto World BEYOND War hosted a supportive panel discussion to help build understanding on:

1) The ways Canadian banks finance colonialism, occupation, war, and climate disaster. Including a special focus on Canadian banks’ complicity in settler colonialism and genocide on Turtle Island and Palestine.

2) How you can move your financial accounts and investments to more ethical alternatives, such as member-owned credit unions.

3) Resources to find collective support for divesting from violence and re-investing in a better future for all!

Thank you to our incredible panelists Eve Saint, Karen Rodman, and Tim Nash.